It has become a common trope to refer to the economic structure of a country – or a currency area like the eurozone – as its “business model”. Never mind that a business firm is an atrocious metaphor for a national economy, let alone a currency area.

Now, in the specific case of the eurozone, running a persistent external surplus is not a business model. It is a necessary consequence of the fiscal rules.

By not giving the eurozone another choice than running an external surplus, the fiscal compact makes it very hard for the eurozone to withstand the impact of Donald Trump’s trade war, or of a potential no-deal Brexit. One way to make up for this might be a helicopter drop of the order of €10bn per month. Will Mario Draghi’s successor have the audacity to try it?

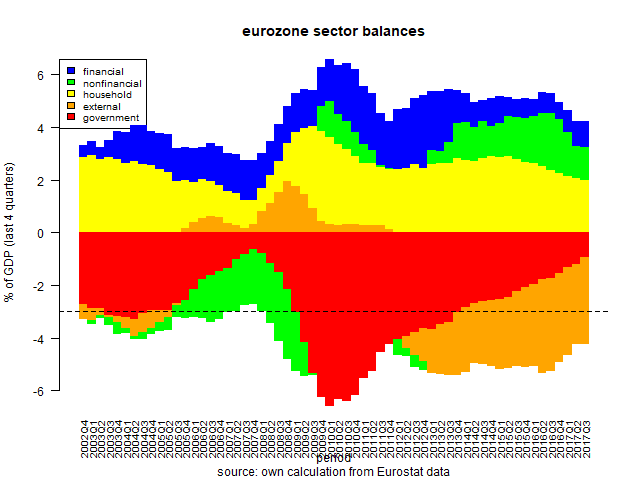

To see this, take a look at the eurozone’s institutional sector balances:

Sectors with balances above the horizontal axis are in surplus, and those below in deficit. The sum of all the balances is zero always because everyone’s income is someone else’s expense. The external sector is peculiar. The convention is that this is the balance of the rest of the world, so a eurozone external surplus is negative on the chart.

The eurozone currently runs an external surplus of over 3% of GDP. This wasn’t always so: between 2005 and 2011 the eurozone had a small external deficit (so the rest of the world was in surplus with it). Except for a bump due to the 2008 recession, for its first decade the eurozone seemed quite happy to be externally in near-balance. What changed at the start of 2012 was the introduction of the fiscal compact. Since then, the eurozone’s governments have collectively reduced their deficit by a little over 0.5% of GDP each year. Despite constant moaning by fiscal conservatives about the European Commission not enforcing the rules, this is actually smack on target:

All EU countries are expected to reach their medium-term budgetary objectives (MTOs), or to be heading towards them by adjusting their structural budgetary positions at a rate of 0.5% of GDP per year as a benchmark.

And, as we can see from the sector balance chart above, the eurozone’s external surplus has grown accordingly.

This is not a coincidence. The private sector(s) cannot but be in surplus on average. Otherwise, they risk insolvency. So, the balances of households and firms – nonfinancial and financial – add up to a hefty surplus. In normal times this is balanced by a government deficit and – since the fiscal compact – an external surplus.

On current trends, by the end of 2019 the eurozone public sector will be in fiscal surplus. Hooray! But the cost of this will be a reduction of the surplus of the domestic private sector(s), or else the external surplus will have to grow to 4% of GDP or even more.

Enter Donald Trump.

The US is responsible for about 1% of the eurozone’s 3% external surplus, and Trump is having none of it. And he seems perfectly willing to throw out the WTO if that’s what it takes to close the US trade deficit.

Closer to home, the UK accounts for another 1% of GDP in the external surplus, which would be at risk from a no-deal Brexit unless the UK adopts a policy of unilateral free trade (no import tariffs on any other country).

So, by the time Mario Draghi leaves the ECB in the autumn of 2019, the eurozone’s private sector surpluses might have to shrink to accommodate a 1% reduction in the public deficit, a 1% reduction in the trade surplus with the US, or a 1% reduction in that with the UK. That could obliterate the private sector’s entire ability to save.

Given that the eurozone’s public sector is limited in its ability to run countercyclical deficits, one way out of the dilemma might be a helicopter drop by the ECB. The required size would be about €10bn/month for each 1% of GDP of lost private-sector ability to save that the ECB wants to compensate for. It may be that Mario Draghi’s successor may need to be even more audacious than him, if they want to do “whatever it takes” to save the euro.

In practice, not all of the 1% trade surplus with the US and 1% trade surplus with the UK is likely to be lost. Also the pressures to minimise public sector deficits could reduce if more countries approach the 3% deficit spending and 60% of GDP public sector debt targets. So while the private sector’s ability to save will be reduced, it will not be eliminated altogether. The EZ could seek greater trade surpluses elsewhere, and private sector savers might want to save less as employment grows and confidence improves. That is the benign scenario. The worrying one is that the EZ has so few conventional policy levers at it’s disposal to steady the ship should storm clouds blow hard. I am unsure of how the mechanics of a “helicopter drop” would actually work, and what its impact on social, regional and inter-generational inequality would be. I am more worried about the political consequences of ever growing inequality than macro imbalances more generally.

LikeLike

I did not get into the details of the helicopter drop, just noted that is the central bank equivalent of a government deficit. At the level of the sector balances a public deficit has the function of supporting the income – and thus the surplus – of the private sector, just like a helicopter drop.

For the EZ to get its US trade surplus elsewhere, that elsewhere needs to be willing and able to accommodate a €100bn annual deficit. It is not clear that this is possible.

The austerity pressure will continue. The quote about the 0.5% structural deficit reduction applies to countries that don’t have excessive deficits. And the fiscal compact requires the excess debt above 60% to be reduced over a 20-year period.

As to the trade surpluses with the US and the UK, both are about €100bn out of a total trade of about €12bn. If the US raised tariffs on EU imports by 10% (the average tariff is 3% currently) it could negate its deficit with the eurozone. Trade won’t stop, the surplus just might. The figures for the UK are similar.

LikeLike